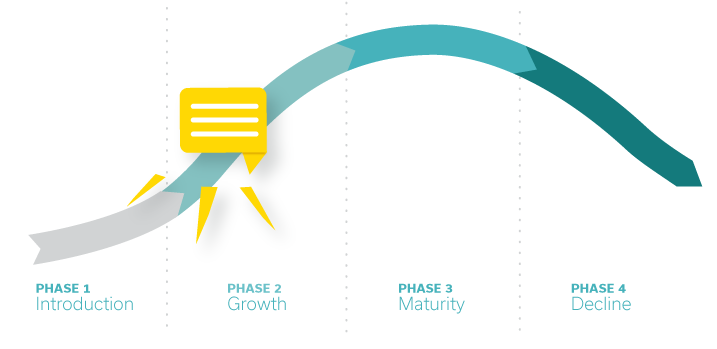

“In January 2020, I had an objective to help create the market for conversational chatbots in healthcare. I estimated it would take another two years before the potential and viability of chatbots would achieve enough mainstream industry awareness to shift from INTRODUCTION to the GROWTH phase. Three months later, that objective had been met because of COVID-19.”

Greg Kefer, CMO LifeLink

Conversational technology is not new. There are widely used conversational solutions in multiple consumer and business segments. Millions use Alexa to place Amazon orders and play media through voice commands. Website helper chatbots from companies like Drift and Kore.ai answer questions and serve as front line, high-scale digital support agents before humans are needed.

Chatbot IT is not a small market. It’s already big and growing. Some estimates peg the global market for chatbots at $2.6 billion, with a CAGR of 30% over the next five years.

But healthcare has lagged consumer industries when it comes to successfully implementing conversational bots into core workflows and patient care. High levels of complexity, regulations, bureaucracy, and risk aversion have kept the healthcare industry about a decade behind leading innovators. There has been significant progress with conversational tech in healthcare, but we have not yet seen a flood of chatbot RFPs or dedicated coverage by the big research analyst firms.

Most of the focus in healthcare has been on digital triage bots that help patients diagnose symptoms to divert non-urgent patients away from expensive Emergency Room care.

There have also been several promising examples of chatbots making a significant difference in high-volume workflows at healthcare innovators. My company, LifeLink, has made a number of announcements that showcase success at some very large hospital systems.

Despite all of this traction, the chatbot technology market in healthcare was still in an “early” phase as of January 2020. Simply visit any large healthcare trade show, check out the massive two story booths, and you get a sense of where the IT attention and spend was focused: big complex systems of record, with massive integration and data interoperability challenges, represent billions of annual IT investment. And, it’s been that way for decades.

The prevailing perspective on what represents an effective system of patient engagement solution is to arm human agents with NASA command center screens that present a complete picture of the patient on the other end of the line. The concept of a better method of interacting with that patient is an afterthought.

Conversational chatbots as key, high-scale digital assistants are in the mix, but would need a few more years to prove out value propositions and get case studies published before they move up the ladder into the realm of a must-have, mission-critical capability.

IT Markets Take Many Years to Mature, But Not Always

Technology, like most markets for new products, go through a series of maturity phases — there are many academic papers on this. Broadly speaking the process falls into four phases: introduction, growth, maturity, and decline. But in the world of technology there can be huge variances in adoption speed. Sometimes we see a cool, simple new product go through introduction, to wild success, to history in just a few years. Others can take decades.

Facebook launched in 2004 and went from 0 to 100 million users in four years. The social media market is here to stay, it’s massive, and it took about four years to mature. Conversely, the Electronic Medical Records market matured slowly from early projects in the mid 1960’s until the HITECH act became law in 2009, which ignited adoption — that’s a roughly 50-year maturity cycle!

Among the countless sources of product evolution, this model is fairly straightforward.

Outside Events Can Change Gears and Ignite a New Market

Sometimes it takes a major, unfortunate event to shake loose entrenched mindsets or rigid, inflexible processes. External, immense pressure brings on a next-level “survival” gear.

I spent the first decade of the 21st century promoting a new cloud technology product market, referred to as supply chain visibility — the ability to see where goods were during production and shipping. We were in the midst of a ten year battle against big software incumbents, and globalization was taking hold. Then a natural disaster struck the other side of the world and everything started to change.

In Japan, the earthquake and tsunami took one of the world’s leading manufacturing hubs off the grid for months. Automakers couldn’t get parts from suppliers. Finding and routing alternatives was nearly impossible. Companies struggled to get a handle on their supply chain networks, they hit the phones and formed war rooms to deal with the crisis. The problem is that few companies had the ability to “see” what was happening across the vast network of partners they relied on to bring their products to market. No amount of human resources could solve the problem fast enough.

It wasn’t just the Japan disaster. Countless events big and small continued to wreak havoc on businesses, ranging from floods, to political unrest, to container ships sinking. These were all challenges companies didn’t face when they operated in mostly North America and Europe. Once they outsourced 80% of their manufacturing to the other side of the world, they suddenly had to have visibility.

As the need for “sight” became apparent, the case studies my company had published about how companies like Caterpillar, Pfizer, and Lenovo navigated supply complexity helped flip the market. Supply Chain Visibility had entered the Maturity phase. Today there are more than 20 companies making more than $50 million per year selling supply chain visibility solutions, while countless others scramble for a piece of the pie.

The Impact of COVID19 on the Healthcare Chatbot Market

Today, healthcare — and the world — is facing its version of that big, unforeseen event that is forcing a complete reset of thinking across the spectrum. The massive spike in demand that’s crushing NYC hospitals today, and others soon, has forced the industry to think about massive scale and efficiency.

There has been a major push to get conversational chatbots in place on the front lines to automate screening and intake for COVID-19 patients because call centers and telehealth solutions were never designed to support a 10x spike in volume. So far, chatbots have shined with significant press coverage of success stories.

In addition to conversational tech specialists like LifeLink, even leaders like Microsoft have gotten a degree of “chatbot religion” thanks to some high profile successes they have had with the CDC and some hospitals.

Maybe Microsoft is now discovering the potential of conversational technology. It works with patients because it’s simple, intuitive, and sticky. Engagement rates are typically 3-7x other solutions and that’s precisely what’s required in times like these. That’s also what will be required as the healthcare industry moves into a long COVID-19 recovery phase.

Importantly, we know COVID-19 will come to an end. But the power of this new conversational mode will not soon be forgotten. Healthcare companies will naturally start asking questions like, “what else can this do?” and they will see the success stories published during the Introduction stage and they will act.

In January, this CMO thought 2021 or 2022 would be the moment for conversational technology to jump to the growth stage, signaling that the healthcare industry was ready to shift into a more intense engagement mode across the full spectrum of service areas and workflows. That time horizon has been shortened by 90% but everyone will win in the end.